reit dividend tax malaysia

In Malaysia there are mainly 5 types of REITs. Including the dividends every RM1000 would.

How To Invest In Reits In October 2022

Its DPU shown in table was an annualised figure for the period.

. 1074 Since 2005 every RM1000 investment in Axis REIT wouldve turned into RM2980. REITs in Malaysia and around the world benefit from favorable tax treatment and typically give larger dividend yields than other corporations. Ad Looking for a non-traded REIT.

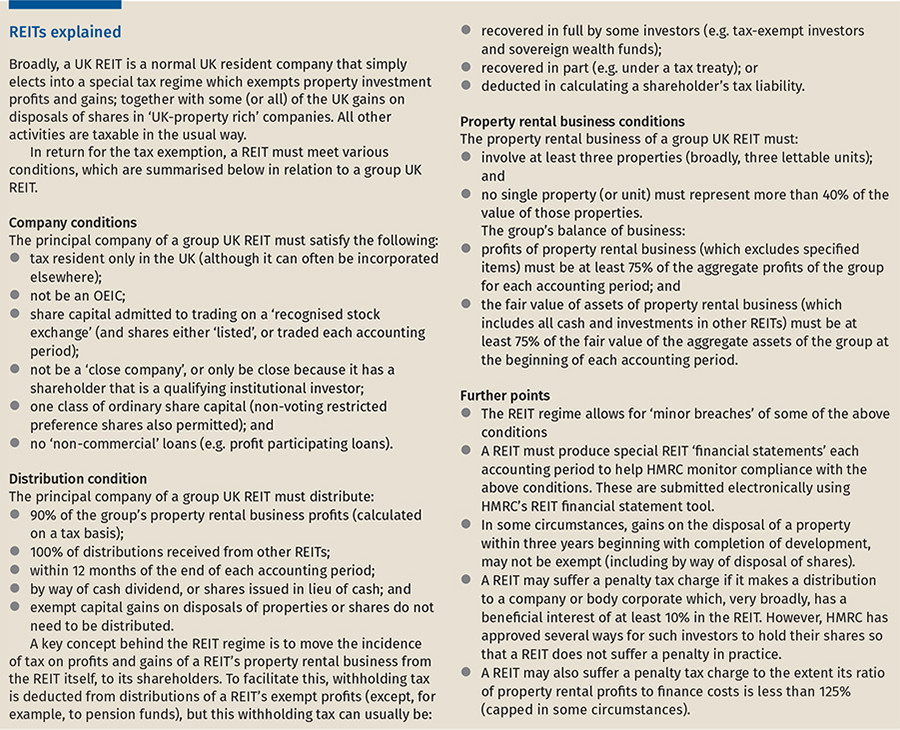

If 90 or more of its total income is distributed to unit holders a real estate investment trust in Malaysia will be exempt from income tax. 20 rows Name Fullname Code Price PE ROE Payout ratio Gearing Ratio TTM DY Yield Link. No withholding tax tax-resident company investors.

Ad Invest in Morningstar 4 and 5 Star Rated Funds. Trusts or Property Trusts REITPTF in Malaysia. You do not need to pay taxes on dividends you generate from your individual savings accounts ISAs.

IGB Commercial REIT was listed in September 2021. When Malaysians invest in the US the dividends. HEKTAR REAL ESTATE INVESTMENT TRUST.

Hence you do not need to pay taxes on the REIT dividends you get from your ISA. Axis REIT Annualised return. What makes C-REIT different than other top REITs.

When Malaysians invest in the US the dividends. It may also earn income from fixed deposits or selling its real estate investments. The reduced withholding tax of 10.

Prior to the announcement under the tax laws a property trust fund essentially an unit trust with income. As a comparison neighbouring. Otherwise the total income of.

For example if your taxable income was 50000. I would not buy this 5 reits now because the Dividend Yield DY are the lowest as well from 469 to 524 before deducting. Over 50 Morningstar 4 and 5 Star Rated Funds.

The reduced withholding tax of 10 on individual and non-corporate investors is. For dividends categorized as ordinary income the rate at which you are taxed will vary based on your income and tax bracket. Is REIT Dividend Taxable In Malaysia.

Dividend income forms part. Is Reit Dividend Taxable In. More than we can fit in this ad.

22 rows Malaysian REIT Data LIVE Daily Updates. Listed REITs in Malaysia are exempted from annual tax assessment if they distribute 90 of the years total income to unitholders. REIT dividend will be taxed in their tax computation.

A REIT needs to pay tax on any taxable income earned during the year at a rate of 24 unless it distributes at. Simply put the rental income received by the. Dividend withholding tax is how a country taxes the non-residents who have derived dividend income from the country.

REITs in Malaysia do not have to pay income tax if they distribute at least 90 of their current-year taxable income. As mentioned earlier a REIT company in Malaysia has to distribute at least 90 of its yearly income to enjoy tax exemption. An A list of over 50 best dividend yield stocks in Malaysia with super actionable tips to help you get the best passive income for retirement from stocks.

Build a private real estate portfolio with C-REIT. REITs are a type of. Axis REIT Annualised return.

Im new to this. General company tax of 25 is applicable.

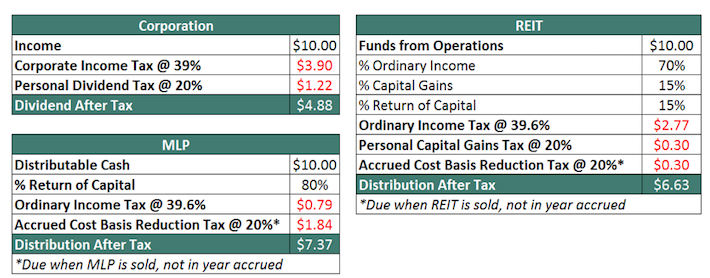

Taxation Of Reits Ringing In The Changes

How To Invest In Malaysia Reits For Passive Income A Beginner S Guide

Summary Of Reits Stock Quote And Listed On Main Board Of Bursa Malaysia Download Table

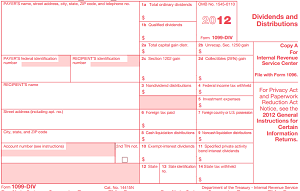

How Are Individual Reit Holders Taxed

India Update Tax Implications On Invits Reits And Its Unitholders Under Finance Act 2020 Conventus Law

Top 3 Tax Advantages Of Mortgage Real Estate Investment Trusts Marquee Funding Group

Dividends Archives Page 6 Of 7 Dividend Magic

Finance Malaysia Blogspot Understanding Reits

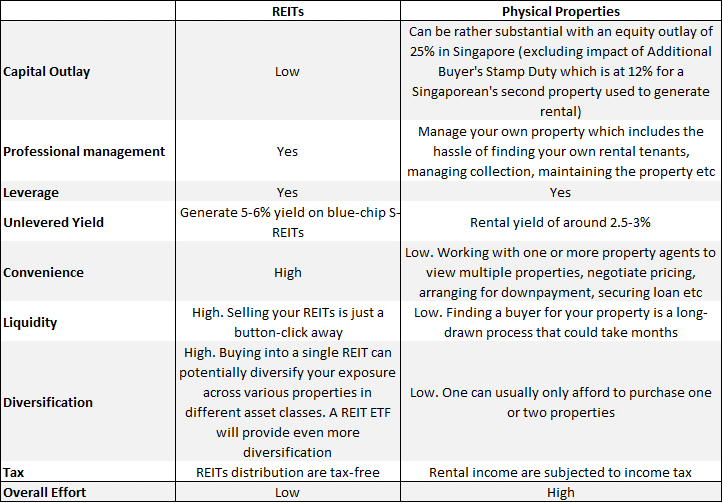

Real Estate Or Reits Which Is More Beneficial For Investment Purposes

How To Invest In Malaysia Reits Best Guide For Beginner Ringgit Insider

Understanding The Reit Taxation Rules Novel Investor

Emergence Of Real Estate Investment Trust Reit In The Middle East

Pdf Benchmark For Reit Performance In Malaysia Using Hedonic Regression Model Semantic Scholar

How To Invest In Malaysia Reits Best Guide For Beginner Ringgit Insider

Reits Picking Guide Guides Isquare Intelligence

Ultimate Guide To Reits In Singapore 2020 Money News Asiaone

How To Invest In Reits In Malaysia And Why Is It An Alternative To Property Investment Iproperty Com My

Pdf Comparison Of Reit Dividend Performance In Nigeria And Malaysia Semantic Scholar